|

| 1 min ES_F showing highs 1425.75 |

We hope you learn something but most of all remember you must craft your own plan before you can succeed in your own trading.

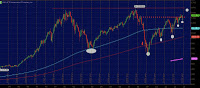

Do not let today's bullishness catch you with your pants down as deal or no deal is still being played on capital hill. It looks as if a deal is priced in and we will continue on a path higher if a deal is reached.