|

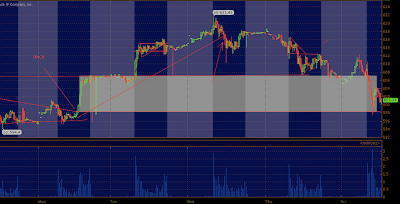

| 1 hour ZB |

The 140 level in ZB gave way with conviction, the auction today at 1 really did not help the equation.

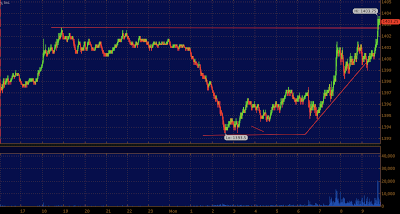

Equity markets largely ignored the dollars strength today. though did succumbed to the 81 level later int he session as apple stumbled. I my opinion this dollar rally do not have much more legs left..

|

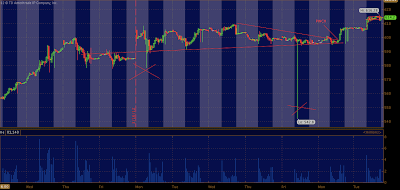

| Daily ZB |

Either equities break down ( i think not) or the EURO bounces adding a bid at the back of equities.... it is down from 1.348 to 1.303 in two weeks, all on the heels of a strengthening greece picture/europe picture.

Yes Greece is still in the hole, but they are a hell of a lot more stable than they were three months ago.

You tell me what is going on her? me thinks cash slowly moving out of bonds, into equities.. THOUGH the strength of the dollar is causing arbitragers to sell the index's, almost canceling out the fresh money coming out of bonds into equities... Or we see dollar rise and equities stay bid, i doubt it happens..

Last time the DX was at 81, crude was actually LOWER at 102.20. the proverbial rubber band is stretched beyond comprehension